Token Economy Interview with DAOLaunch CEO, Sakuro Imayama

DAOLaunch’s CEO Sakuro Imayama was recently interviewed by The Token Economist, below is the transcript of the interview.

Kato: First of all, please tell us about Mr. Imayama. Looking at the profile, it seems that you’ve had a long relationship with crypto assets since 2015. What have you been doing so far?

Imayama: The reason I entered the industry was that I was interested in reading the article on the Byzantine general issue of Bitcoin in an article on the Internet. I used to work for a Japanese company, but I immediately quit the company thinking that Bitcoin wouldn’t come. Since then, I’ve been working in the blockchain industry alone.

Originally, I liked to see trades and charts, and at that time I was creating trading systems and arbitrage tools because there was a big price difference between exchanges. The more I knew about cryptocurrency, the more interesting it was, and I became more and more absorbed in this world.

Kato: You quit the company and bet on the world of crypto assets. Was there anything you could be sure of?

Imayama: I was simply bold and always had a habit of making a quick decisions. I thought that crypto-assets seemed to be very interesting, and when I actually tried it, the place where I made money was still big.

And not only the money but also the knowledge side was very attractive. Blockchain is difficult in terms of content and ideas, but as I study more and more, I come to understand it and want to know more smart people who are active in the industry.

The people who are doing blockchain are doing it with the idea of changing the world from nothing at all, and there are a lot of people who are actually changing it. After all, I have a dream, so I would like to do my best with a full commitment there.

Kato: I feel that I myself am looking around when it is an industry that has dreams.

Background of the launch of DAOLaunch

Kato: What was the background to the launch of DAOLaunch?

Imayama: From October 2020, new trends such as DeFi and IDOs began to emerge, and anyone was free to list their own tokens on DEX. So, interesting startups appeared one after another, and I started thinking about investing in startups for projects that haven’t been listed yet.

The IDO launchpad trend started with Polkastarter and DuckDAO. These basic styles are that venture capital (hereinafter referred to as VC), which is famous in the blockchain industry, puts capital in private sales etc., and general investors compete for a small number of slots called whitelist.

They got it right because a project with a good ROI started coming out, but when we tried to invest in it, other VCs were already investing and we couldn’t. So, if you think purely and don’t put in at the timing when funds flow in privately like other VCs, it will be difficult to make a profit. At that point, the advantage is different from that of general investors.

As a startup in a field where IDO is widespread when I thought about what to do, I thought that it would not be profitable unless I was in the position of VC. So, at first, I thought about branding myself as a crypto asset VC.

On the other hand, there are quite a lot of people complaining about the method that VCs get tokens at a closed and cheap price and sell them to retail investors at a higher price. This is not fair.

Isn’t blockchain the liberation of the financial business? But that area is not yet decentralized. There is definitely a demand for ways to decentralize and democratize it. DAOLaunch addresses this problem. There is a lot of demand in this area, and there are people other than us who are taking different approaches.

Even if there are several methods in the world of IDO, the mainstream is VC, and the composition of selling high to general investors has not changed. Basically, those VC funds are not democratized, so one of the motivations of DAOLaunch is that if they can be democratized and become free competition, they will be accepted.

And the approach buzzes if we create a platform that allows any investor in the world to freely brand themselves as an investor like a VC and negotiate favorable investment terms on-chain.

There are some more democratic approaches, such as fair launch but when it comes to whether it’s realistic, there aren’t many examples that work. There is a wall to democratize somewhere, such as receiving funds in stock and fair launching only for tokens.

My experience is definitely the reason. When I approach VC people, they provide non-capital elements such as marketing and connections in addition to capital. After all, the fact that a startup can succeed is a big factor because they were there. It’s as important as capital and more important than capital.

Therefore, I had to think about the current VC business model. As for what they are doing, they have their own portfolio and brand as an investor in the form of “I made so much money”, “I have such a network”, and “There are such merits if I connect with myself”. It is the world of VC that puts capital based on such achievements. We can negotiate favorable terms because we have a proven track record.

I thought that if we dropped these on-chain, the world of financing could be democratized. This idea is the basis of DAOLaunch.

Kato: When I was thinking of becoming a VC, it was quite interesting to come up with the answer of democratizing VCs.

Imayama: We just announced an IDO, so “Please give me a token allocation for sale. Why are our funding limited to IDO even though it is a platform where various people can participate in investment? There are people who say, “?”, But no, we are different from fair launch!

In order for a startup to succeed, it will be to give investors superior conditions on a contribution and performance basis. Given the most realistic startup success, it means giving allocations according to ability. DAOLaunch does it on-chain.

The DAOLaunch team has hires from Vietnam for the development team, UK, Dubai, South Africa for the marketing team, and more recently India. Also, there are some members from VC. I’m not particularly aware that it should be an international team because it’s a blockchain, but I think it’s definitely a risk hedge if everyone is in different countries and their backgrounds are different. As long as you are a human being, each person will have their own bias.

I myself worked as a backpacker in various countries when I was young, and I also had experience as a taxi driver in Alaska (laughs). That’s what helped me make a business presentation in English to overseas VCs. It is a little useful. Of course, if you are an excellent person, we will hire you regardless of country. And the most important thing is whether you can share your passion.

Introducing DAOLaunch

Kato: What kind of project is DAOLaunch? There are various funding platforms out there, such as crowdfunding and IDO, but what’s the difference?

Imayama: DAOLaunch is an on-chain funding platform. Not limited to blockchain, we should look at it from a broader perspective than general funding platforms. The difference from general stock-raising crowdfunding is that exits are secured by smart contracts. Equity funding platforms often end up without listing or exiting.

However, with blockchain, AMM DEX allows anyone to list their tokens at no significant cost or hassle. Therefore, exits can be secured with smart contracts on DAOLaunch. To be precise, investors will not invest in detailed exit information, such as how much of the collected funds will be added as liquidity, how long the liquidity will be locked, and at what price it will be listed. You can check.

Kato: What exactly will it be like?

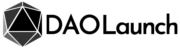

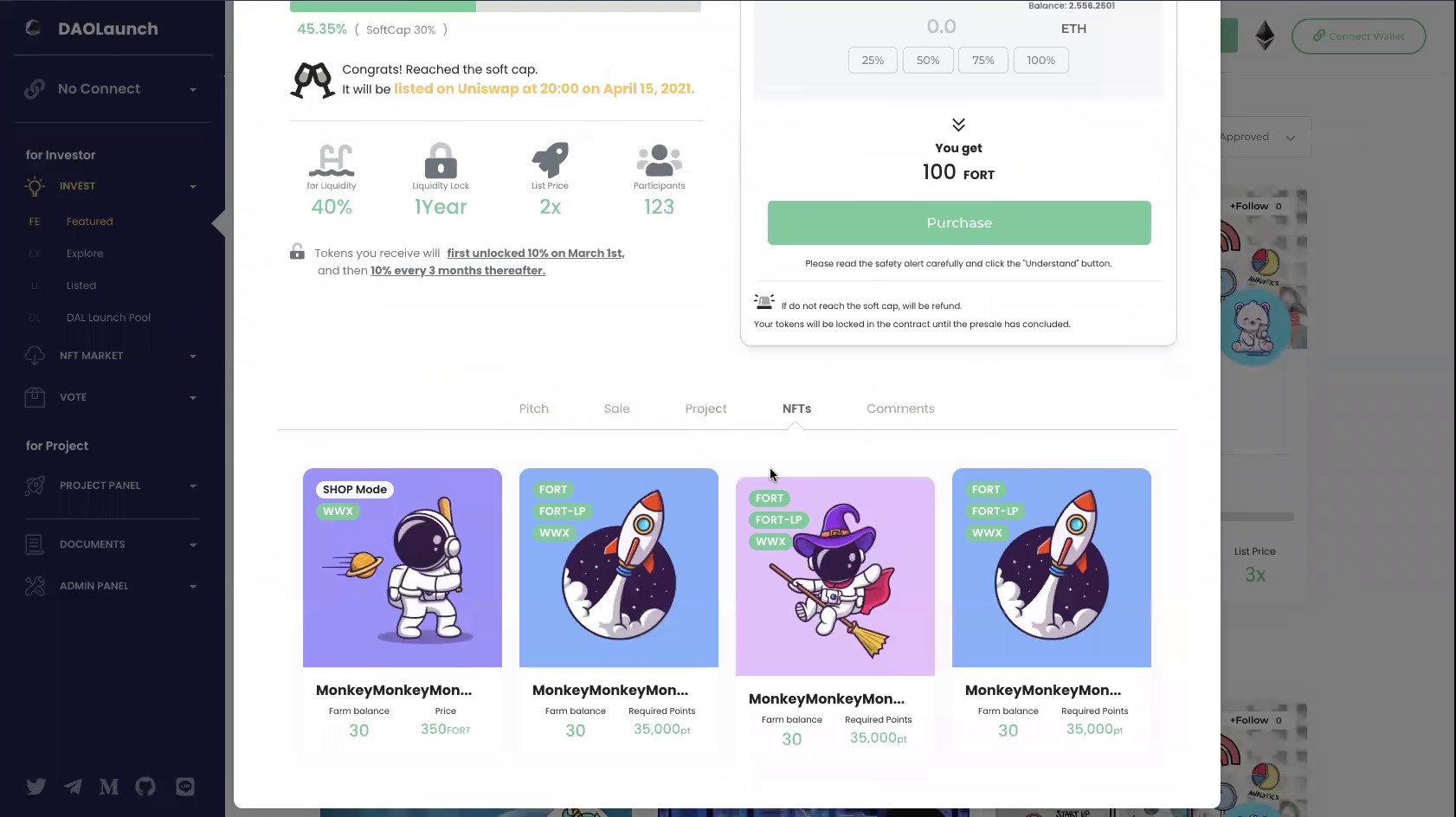

Imayama: From here, I will explain by displaying the screen. For example, on the DAOLaunch funding site, you will see the following screen. As shown in the upper left, 40% to liquidity, 1-year lock, etc., all of these are listed and secured in the smart contract.

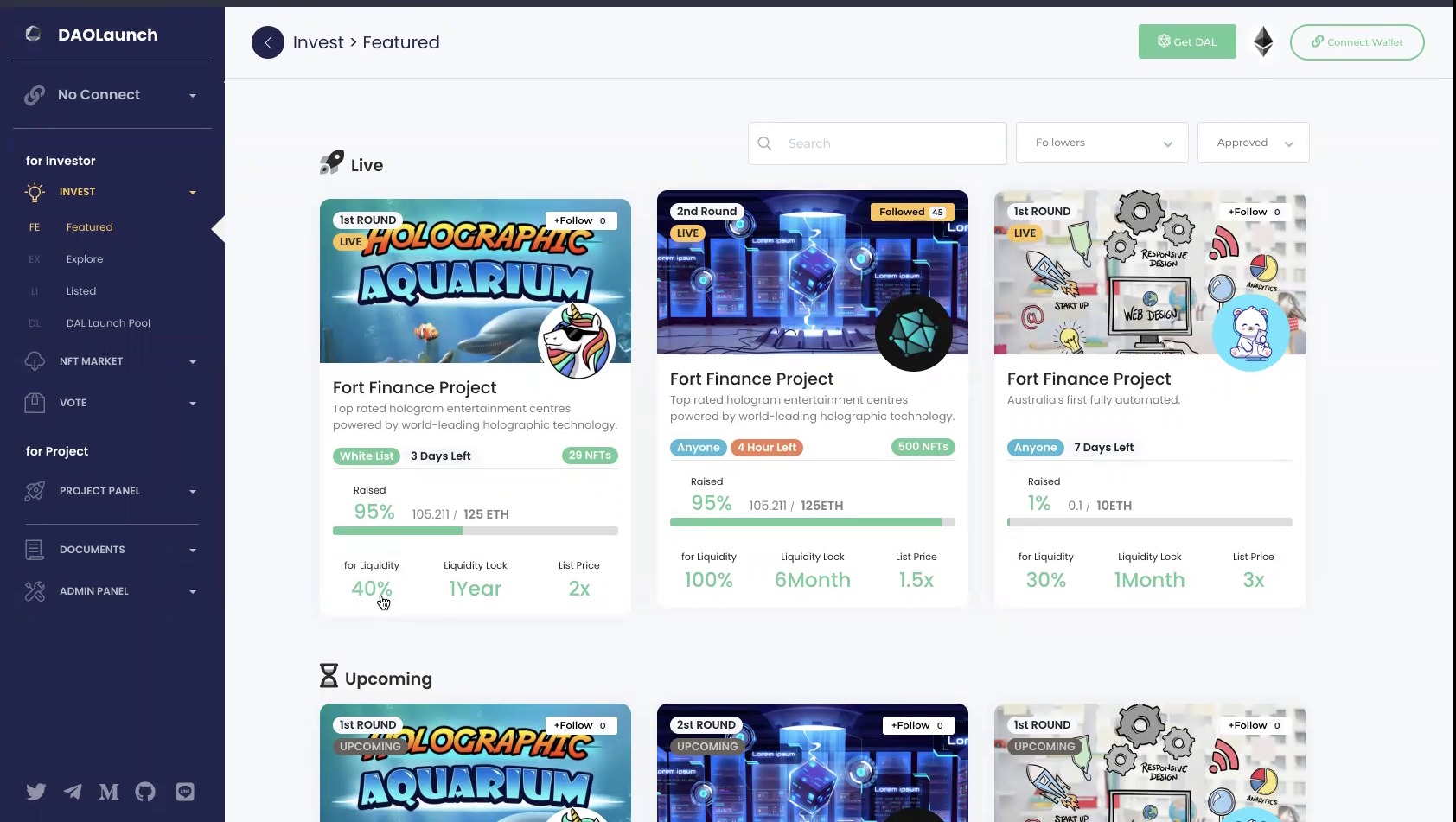

Imayama: The details of the project are like this, and white papers and pitch materials can be posted. And the token metrics are displayed on the right. These are also guaranteed by smart contracts. For example, if 20% of the token allocation is on the team and it says 3 months lock, it is actually locked by the smart contract. By the way, tokens can be issued on DAOLaunch.

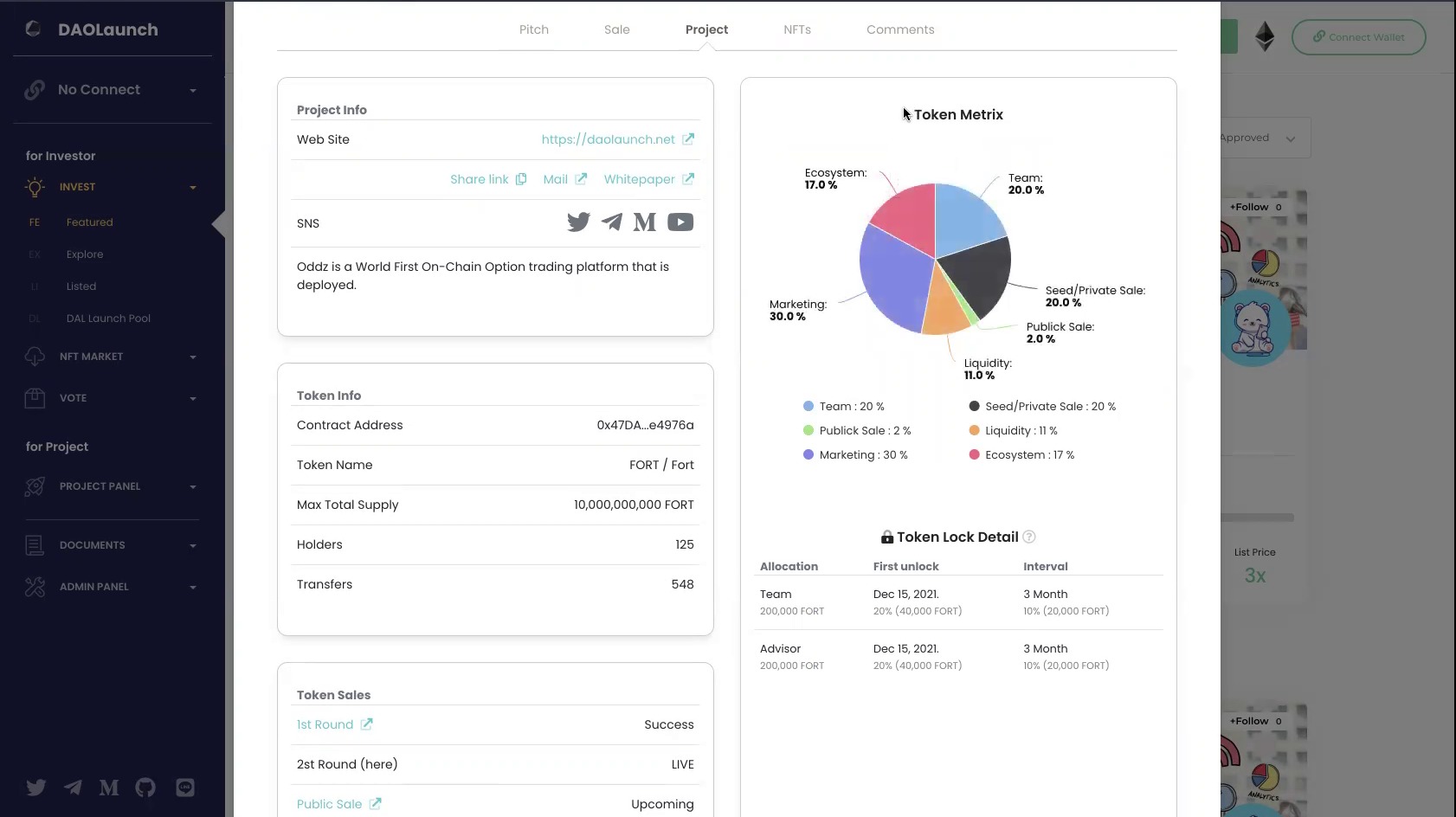

Imayama: And you can also choose which exchange the token will be listed on. This is an example of a mockup, but in reality and AMM and DEX is automatically selected depending on the network you are connected to. You can also set other detailed parameters such as whitelist.

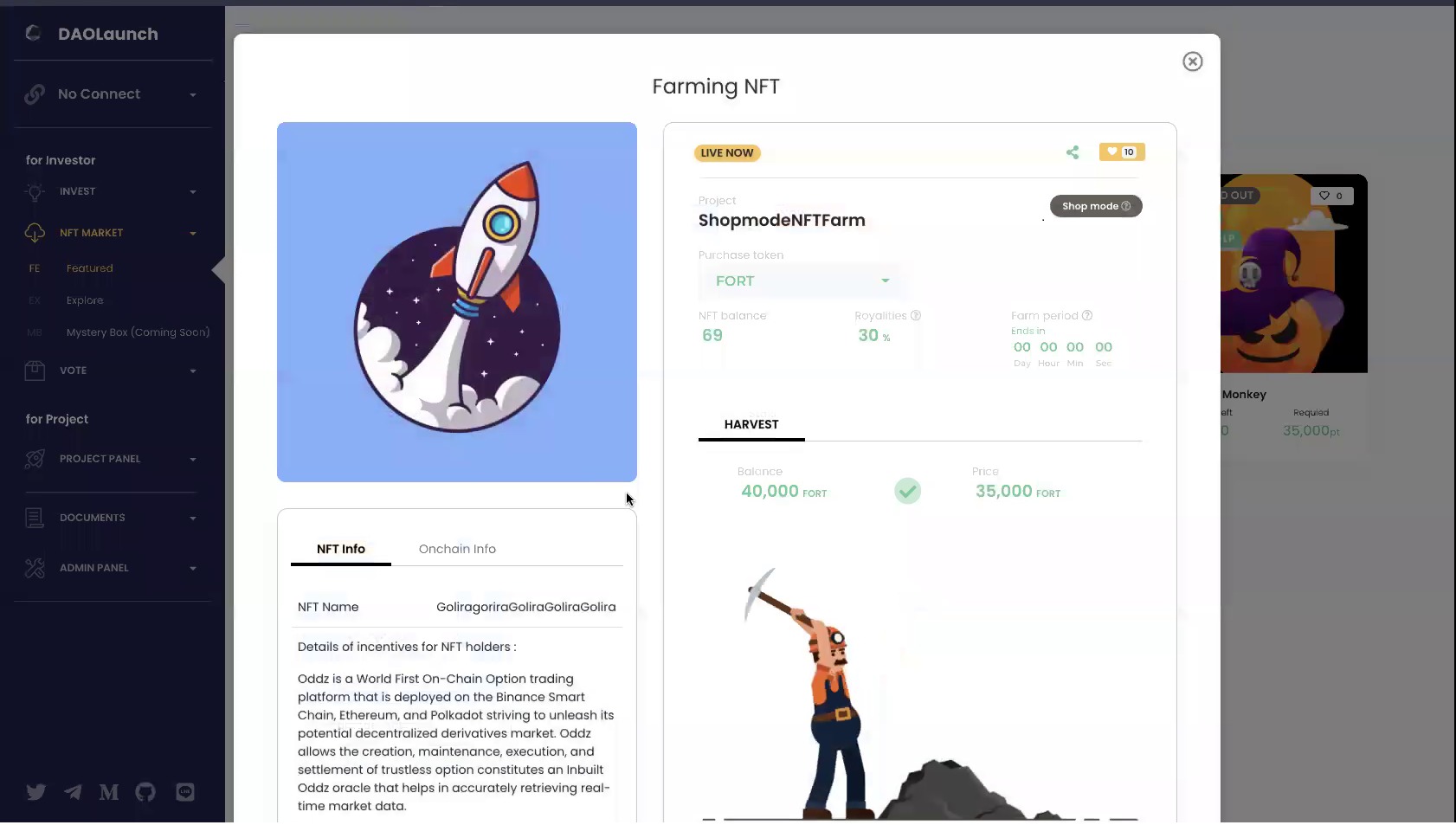

Imayama: In addition to this, we are also particular about the NFT function, which is mainly for projects that are crowdfunded with products. It is suitable for projects that create value with NFT and seek utility. For the project side, it is possible to grant NFTs to users by making it possible to buy NFTs with the tokens they created, or by staking project tokens and LP tokens.

Imayama: These features have already been implemented in the beta apps we have released. The ability to negotiate investment terms on-chain according to investment performance, mentioned at the beginning, is another step. First of all, we will put all investment behavior into the on-chain.

Kato: Frankly, I felt that the screen composition was beautiful.

Imayama: That’s right. DAOLaunch designers don’t like the atmosphere of token projects. And we can’t do the same thing as Polkastartar, so when we think about incorporating non-blockchain startups, we first need to create an interface that can appeal to those people. It is.

Kato: Can anyone create a token sale?

Imayama: You can. However, by default, the projects displayed to users are classified and reviewed as “Approved”. Projects that have not been reviewed are hidden by default. In this way, try to keep users from seeing weird projects as much as possible.

Kato: By the way, what is the difference from other launch pads?

Imayama: The big difference of DAOLaunch compared to other IDO platforms is that the utility of native token ($ DAL) is not provided for securing investment quota (allocation).

Launchpad’s token utility model is typically the allocation of projects that they incubate. However, current IDO projects have to increase the ROI of the projects listed to attract customers, and the total funding as a platform is smaller than that of popular funding platforms (such as Indiegogo). This is because if the total amount of funds raised is increased, the supply of tokens after listing will increase and the price will not rise easily.

This has a considerable disadvantage in the structure of the business model. The main launchpad’s business model is to get 1 to 5% of the amount raised as a commission, but the smaller the total amount raised, the less profitable it is.

Also, I think the current IDO revolution has greater potential, and the technology of providing liquidity and pricing without the intervention of a third party is the technology for all startups. I think it will bring about a big revolution in financing.

And what we’re trying to do is bring the VC business on-chain and bring more free competition to startup funding. Therefore, the token utility is placed in the place where “it is possible to issue a DVC-NFT that can negotiate favorable investment conditions”.

DVC-NFT is an abbreviation for Decentralized Venture Capital NFT, which secures allocation by voting for projects that it supports. All projects are ranked on several ratings on DAOLaunch according to their progress and market ratings. And the better the evaluation performance of the projects invested in the past, the more favorable investment conditions can be negotiated on-chain.

Again, the current VC business model is to brand your company based on your investment performance and portfolio to ensure good investment conditions. They use the value they can provide to startups (network, marketing, human resources, etc.) as a bargaining factor, invest in good conditions, and continue to improve their investment performance.

In order for a general investor to brand as an investor like a VC, it is necessary to provide an incentive from a VC-like perspective to support the project in which he/she has invested. Therefore, as with the current VC business model, we are envisioning a mechanism to secure better investment performance on-chain for investors who have achieved good investment performance.

You can see the demo video of the DAOLaunch app (Main 1.0) here.

How to Prevent Fraud In A Decentralized Manner

Are fraud countermeasures sufficient?

Kato: When it comes to crowdfunding in a decentralized environment, ICO is something that I always remember. There are many ICOs that are fraudulent from the beginning, and many that the project went bankrupt and eventually became fraudulent. In the first place, since most ICOs are venture investments, the probability of death of the project is high, but are there any measures taken by DAOLaunch so as not to repeat the same thing as ICOs as much as possible?

Imayama: First of all, DAOLaunch secures exits with smart contracts, so the liquidity provision ratio and lock period cannot be changed by the startup later.

On our platform, anyone can use the token creation feature to create tokens and the token sale creation feature to create a sale. However, by default, we have introduced a mechanism to hide unauthenticated users.

Also, using the investor voting system I mentioned earlier, we have implemented a “distributed due diligence function” that picks up the most voted projects. Project due diligence is centralized at all launch pads and exchanges, but DAOLaunch provides decentralized due diligence through decentralized venture capital (hereinafter referred to as DVC).

However, it is not always good that everything is decentralized, so basically, the management will meet with the project, conduct due diligence, and pick up to take measures against fraud. In addition, after picking up a project by decentralized due diligence, the final decision on whether it is fraud is made on the advisory board including management. If this mechanism works, we will gradually release the functions of the advisory board to the general public.

We hope that decentralized due diligence will bring together better startups as DAOLaunch gradually spreads and more capable DVCs are born. With on-chain visualization of DVC performance, successful DVCs will be able to invest in other projects at a favorable price, which is their incentive.

Kato: With regard to decentralized financing methods, we have not yet realized sufficient means to prevent fraud, so if this can be achieved, it will be the first in the world.

Imayama: That’s right. I’m preparing to create a structure that can be firmly distributed as a system and bring it there, but I don’t think it makes sense from the beginning. The process for that is realistically ordered.

Can non-blockchain projects create utility for tokens?

Kato: DAOLaunch can also raise funds for non-blockchain projects. In reality, good business does not mean that token prices will go up. Utility tokens are also important for utility. I think this is a high hurdle for non-blockchain projects, considering that projects generally give back to investors with rising token prices, but they may be able to give back to investors. Is it?

Imayama: Yes, on DAOLaunch, we are implementing NFT creation and farming functions on the assumption that anyone can set the token utility. This means that you can sell NFTs created by startups with your own tokens. You can also freely create farm pools to farm NFTs by staking their own tokens and LP tokens.

Imayama: Currently, in the NFT area, an NFT as a collectible is popular, and the focus is on what kind of utility can be created next.

For example, there may be a project that links actual products with NFTs. If you make it possible to buy a product in exchange for an NFT, and if you use the token issued by the project to buy that NFT, I think that a token utility will be possible there.

Kato: That’s interesting. By combining the DAOLaunch platform, you can create demand for projects that have issued tokens through crowdfunding.

Benefits of using DAOLaunch for your project

Kato: There are already various financing platforms, but what are the benefits of using DAOLaunch from a project perspective?

Imayama: One of the merits of the project is that by putting everything on-chain, we will be able to appeal more sincerity to investors.

And DAOLaunch is very versatile as a financial creation platform. Currently, Ethereum and Binance Smart Chain are free to create tokens, which can be used to set tokenomics on the blockchain and create token sales. There is a setting that allows you to upload videos and detailed material instead of the coarse pitch material like other IDO platforms. In addition, you can add whitelist address settings, such as making it possible to invest only addresses that have been verified.

Also, as I mentioned earlier, the NFT function allows you to freely create NFTs, sell and farm NFTs using your own tokens, and appeal to investors as one of the token utilities.

In addition, DAOLaunch offers airdrops (DAL Drop, DAL Launch Pool) on DAOLaunch as part of marketing to facilitate token sales. This is the same concept as Binance’s launch pool, and it is a function that allows you to access the DAOLaunch network by airdropping NFTs and listed tokens to the DAOLaunch token holder.

Normally, airdrops are done for marketing purposes, and projects get nothing in return, but DAOLaunch distributes DAL tokens to projects that are airdropped to DAL token holders.

It may seem like you’re oversupplying DAL, but that’s not the case. DAL token holders will be awarded points for staking DAL and DAL-LP and will use them to receive DAL as interest rates, as well as special NFTs offered by DAOLaunch or DAL Drop NFTs offered by other projects. Can be selected. Therefore, since DAL is provided according to the points consumed, it does not oversupply the DAL to the project, and basically, there is only merit.

This idea is similar to how Polkadot’s parachain offering, like the Polkadot parachain offering, grants their tokens (NFTs in the case of DAOLaunches) as incentives through staking on projects they support.

In addition, DAOLaunch will use the sales generated by DAOLaunch to buy back their tokens from the market after listing in the form of a grant from DAOLaunch for the startups picked up. We call this IBO (Initial Buy-Back Offering). Redeemed tokens will be automatically burned. This idea is based on the idea that DVCs (investors) on DAOLaunch should ideally make a profit on the capital gains they get from the projects they invest in.

What Happens When Venture Capital meets NFTs

Kato: The topic of distributed VC-NFT (DVC-NFT) came up earlier, but I feel that this is a really new concept for NFT use cases. What is DVC-NFT and what kind of future can it be?

Imayama: Regarding DVC-NFT, that’s what I draw in my head. What I really think is that in order to democratize the VC business, it is necessary to bring the VC business on-chain.

What kind of business they are doing is that they have a portfolio and investment record, and based on that, they can negotiate with startups and invest. And if you can achieve good results, you will be able to negotiate with other projects on favorable terms and continue to make profits.

When decentralizing this, we must first be able to record investment performance on-chain. If you record the voting history in the NFT of the decentralized VC and categorize it based on that information, you will be able to know their investment performance. In addition to their investment performance, they also have a portfolio, so if the portfolio is also linked to the NFT, the idea is that the NFT will become the VC itself. That is DVC-NFT.

Then, when I wondered if it was possible to link a seed token to an NFT, it seems that it can be linked. So it is possible to realize that the NFT itself has a portfolio. And if you buy or sell that NFT, you can activate the buyout market of VC itself. Then you might be able to sell your portfolio for profit or lend it to earn interest.

Kato: This is an interesting idea. Once the DVC-NFT trading market is created, it seems likely that hundreds of millions of NFT transactions will occur. It seems that ordinary people are hard to enter the market (laughs)

Imayama: I wish I could do that. Since you can self-reveal using NFT, it may be interesting if you can arrange DVC-NFT by yourself and self-reveal.

Introducing the project that announced the adoption of DAOLaunch

Kato: It seems that there are already several projects that use DAOLaunch. Can you introduce as much as possible? And what did they expect to use DAOLaunch?

Imayama: I avoid direct names, but there are many. Some are regular blockchain projects such as games and anime, professional NFT art, esports and VTuber, while others are funded by commercial crowdfunding. They were interested in DAOLaunch because they wanted to raise money first and then make a name for themselves in the world.

Imayama: I would like to introduce The First Bid Foundation. They are a project to support new talented NFT artists. Gather famous artists in the NFT world and sell their NFTs to collect royalties. We support new NFT artists based on the royalties earned.

First Bid means “first bid”, but the first bid is a tremendous amount of hurdles and courage for new NFT artists. People who have a certain degree of name recognition have already gathered, and as you can see, there are people who make apt art.

Kato: It’s a project that feels the social meaning of spreading art.

Imayama: Well, I think it’s interesting. I would be grateful if you could help me with DAOLaunch.

Background of receiving investment from VC

Kato: DAOLaunch has already received investment from several VC companies. Can you tell us how that happened? And what do they expect from DAOLaunch?

Imayama: Basically, I don’t think VC is paying some attention to the growing market. They sympathize with the fact that DAOLaunch is different from a normal launchpad, it closes the gap with non-blockchain, it is an approach to democratize VC funds, and fair launch is not a realistic approach. It seems that. That is the point that is being evaluated.

Press Release On Financing

DAOLaunch Funding Press Release

Kato: Please tell us if there is a partnership that DAOLaunch is currently looking for.

Imayama: The partnership we want is people who sympathize with DAOLaunch’s vision and try to liven up DAOLaunch together.

DAOLaunch has recently started several programs. We are currently holding an advisor program and a community rewards program on DAOLaunch.

First is the advisory program. DAOLaunch aims to enable general investors to negotiate and brand investment from the same perspective as VCs. However, at first you need to get the lead from an investor who can really increase the value. In the advisor program, experienced investors are invited to become decentralized VCs, introduce various startups, and think about what kind of added value will be added to startups. We are looking for. If you actually introduce it, we will give you a DAL token as a successful referral when the financing is successful.

Kato: As a reward program, you have set a pretty good amount.

Details of the Advisory Council Program

Imayama: The Community Rewards Program rewards people who liven up our community. After all, the important thing is to have more and more DAL tokens on a contribution basis. In addition to advisory work, we will also give rewards to those who helped DAOLaunch. You can see how to contribute in the community forums. You can also participate in the forum in Japanese.

Details of Community Rewards Program

Details of Community Rewards Program

As we get ready for launch and continue our expansion, we keep looking for passionate and talented leaders to join the movement and scale DAOLaunch.

Future Enthusiasm

Kato: Mr. Imayama, what kind of project do you want to make in the future? Please tell us your enthusiasm for the future.

Imayama: Basically, like the Internet and the revolution caused by blockchain, the Internet democratizes the information business and makes it free competition. I think blockchain is trying to bring democratization and free competition to the financial business. As it is now, if anyone can create tokens and anyone can list them, anyone can create financial products. Legal development is another matter.

I think DAO is also a trend of democratization, and I believe that it will be time for free competition in the capital investment environment by VCs. When I looked around, many people complained about the unequal funding environment, so I think everyone will follow this initiative now.

Democratization of investment capital is of course a hot topic in blockchain, and Fair Launch and Balancer’s LBP are the best examples, but in fact Balancer’s LBP uses LBP as an exit for other projects that have already received capital. I am. Fair launch has some successes, but it’s not really mainstream at all.

After all, what VC currently offers is not just capital, but networks, human resources, and everything else. With a fair launch, it’s a different story whether people who get it at a favorable price will provide the value that is worth it, and it’s quite a terrible story to expect it from general investors.

Therefore, VCs and general investors are on the same level, and more VC business models.

About DAOLaunch

DAOLaunch aims to create an open and inclusive competitive environment for startup investment- the Decentralized Venture Capital concept.

DAOLaunch offers retail investors preferential investment conditions depending on their investment performance recorded on the blockchain. Recorded investments are not editable, as all negotiations are all on-chain. DAOLaunch investors can brand themselves as Decentralized Venture Capitalists and much like traditional VCs, they can negotiate more favorable investment terms.

DAOLaunch aims to change the structure of shady behind-closed-door investment deals to an open and more competitive deal structure that takes place on the blockchain. This will drastically shake up the startup industry.

Website | Telegram | Twitter | LINE OC | DISCORD