How To Evaluate The Growth of A Crypto Project (Part 1)

How To Evaluate The Growth of A Crypto Project (Part 1)

It can be argued that one of blockchain’s most important features is the transparency of on-chain transactions. On-chain transactions are cryptocurrency transactions that take place on the blockchain and are uneditable. Once a transaction occurs on the blockchain, it is visible for all to see.

This transparency has made on-chain analytics an achievement that no other financial market and industry has reached at such a granular scale. Both crypto projects and users have used on-chain data to make more informed decisions when deciding whether to participate in certain projects or not. On-chain analysis has become as important as understanding the user traction of a project at its early stage and deciding whether or not to back it.

The following metrics will focus on assisting users, new and experienced, in evaluating the growth of a crypto project through on-chain and through marketing data.

On-chain Analytics Metrics:

Market Cap

Explorers should understand the market capitalization of a token’s project, which refers to the total value of all the coins that have been minted.

Depending on how many months the project has had its IDO or similar, users might need to check the vesting schedules and future unlocks comparing the market cap to date versus when it’s fully diluted to give users an indication of whether the project is overvalued and has a lot of speculation going on.

Number of Active Token Holders

The keen explorer should check the key metrics of a project’s growth such as the TVL (Total Value Locked), deposits into smartcontract, more tokens in circulation and the actual usage of the dapp when studying the number of active token holders.

Active token holders can give some indication as to whether a project is growing or not but this can easily be manipulated. For example, bad actors can send funds using multiple addresses and proceed to buy small negligible quantities to increase holders for the intended purposes of inflating the number of “active” token holders. Users should not view this in isolation. This tactic used by bad actors doesn’t affect the token’s price, it affects the wallet activity. The best way to sure proof this is to check the price and the number of active wallets over time. The token should also be affected by bear and bull market effects on these actions.

Tracking Increase of Token Holders

Looking at on-chain liquidity for a given pair and on-chain transactions will give an idea of how active a community is.

The timeframe of investment plays a big part in this metric. It will help users to track these metrics overtime to view organic growth. While these kinds of statistics give an indication of growth, they may not be related to the token’s price.

Number of sending and receiving addresses

Users should pay attention to a token’s receiving and sending addresses. This metric can indicate outflow or inflow into the project. It can be said that viewing the address activity has different results for certain timeframes, but viewing this activity can assist users with understanding the liquidity flows and helps users to judge community actions and sentiment based on on-chain data.

Number of on-chain transactions/Trade Volume

It is helpful to know the number of on-chain transactions in order to identify a cryptocurrency’s state of traffic. A high trade volume usually indicates that it is active, whereas a low trade volume indicates the opposite. It is important not to view this in isolation due to bad actors inflating trade volume numbers.

On-Chain Tools

The world of crypto has thousands of tools as apps used to study blockchains and different projects, we have found these to be the most helpful to us.

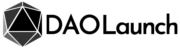

Cryptorank.io (www.cryptorank.io) – CryptoRank provides crowdsourced and professionally curated research, price analysis, and crypto market-moving news.

Users can view market caps, trade volumes, ROIs and more.

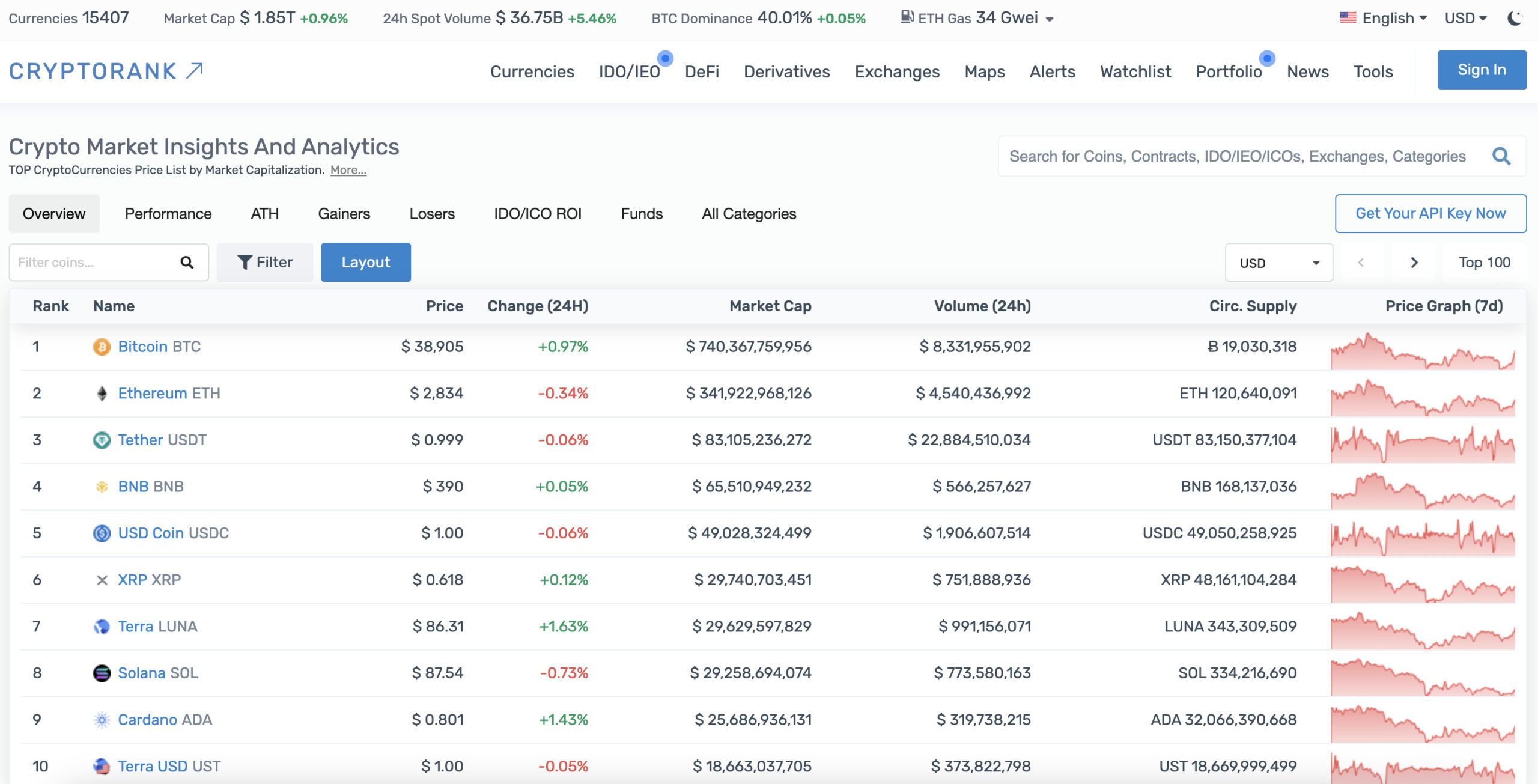

PooCoin (www.poocoin.app) – The PooCoin app provides chart and portfolio management for the Binance Smart Chain and aims to improve on existing DEXes in several ways.

Users can trade coins as well as view their portfolio on multiple charts simultaneously. Poocoin also shows users token trading flows.

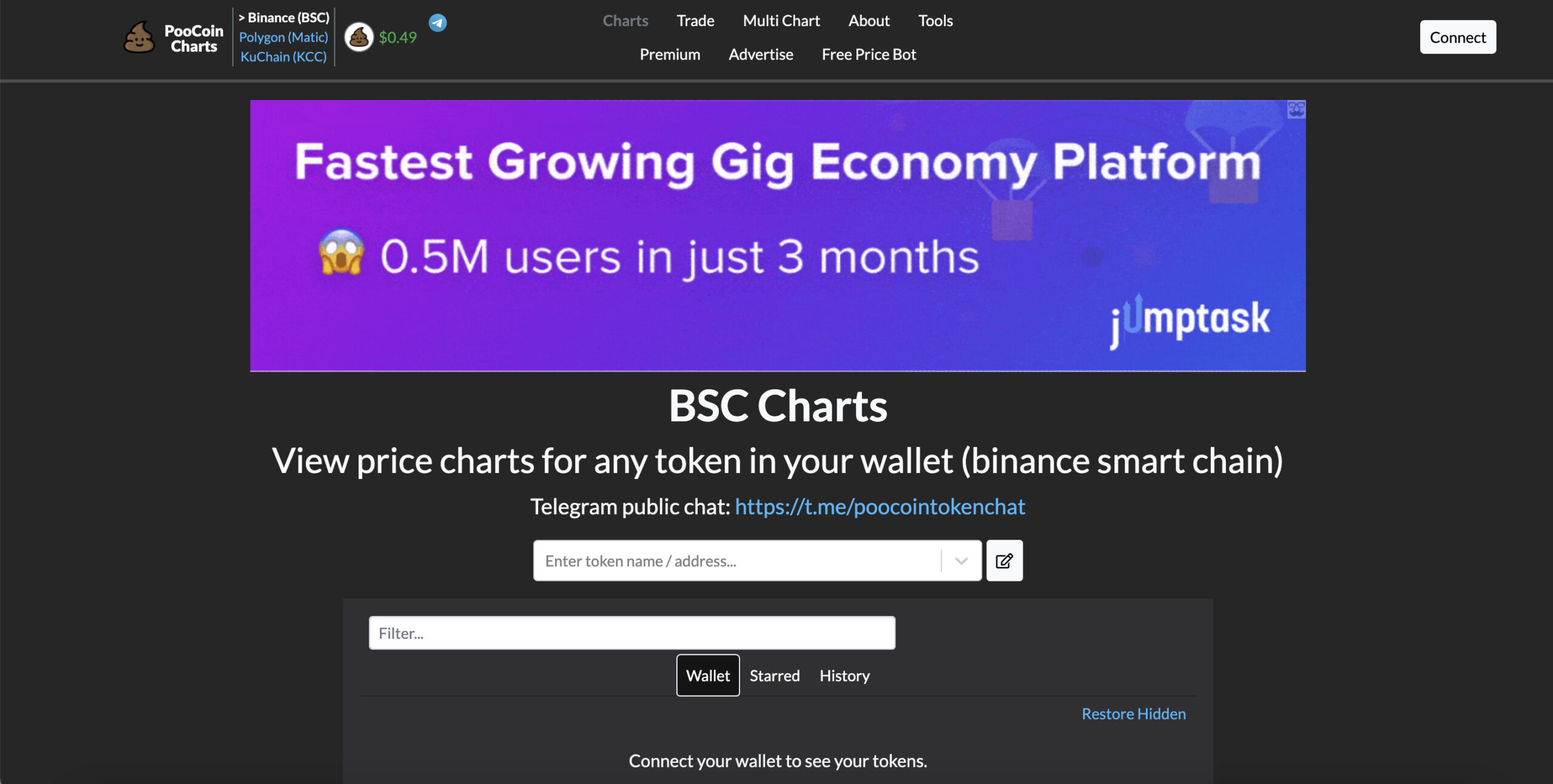

Dexguru (www.dex.guru) – DexGuru gives you unparalleled coverage of on-chain markets integrated into one place and delivered in real-time.

Users can trade, view charts and token flows on dexguru.

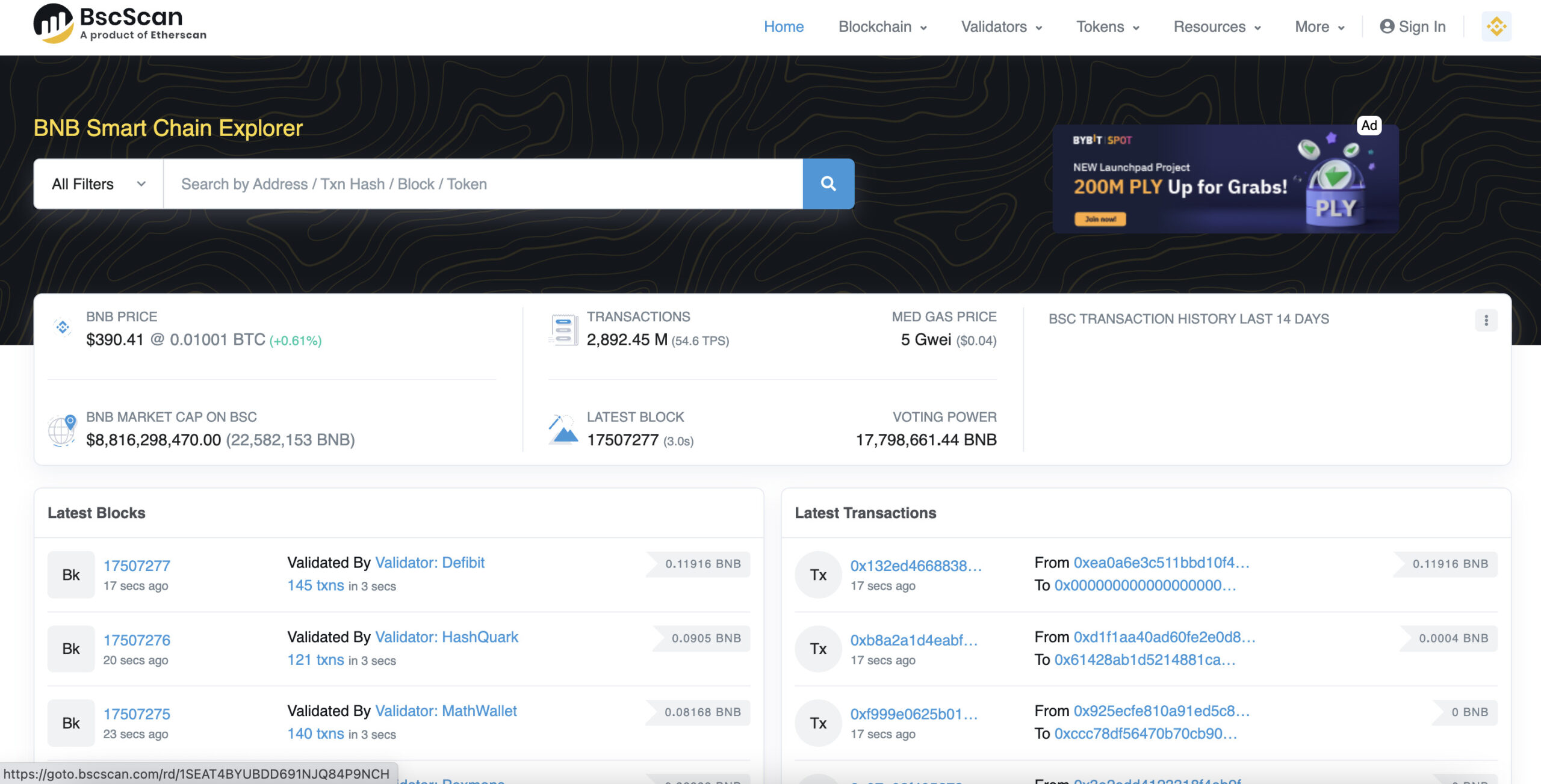

Bscs Scan (www.bscscan.com) – BscScan allows you to explore and search the Binance blockchain for transactions, addresses, tokens, prices and other activities taking place on Binance. Users can view other alternatives such as Eth scan to search blockchains that apply to them. Users can view tokenholders, daily trade volumes and more.

Paid Research

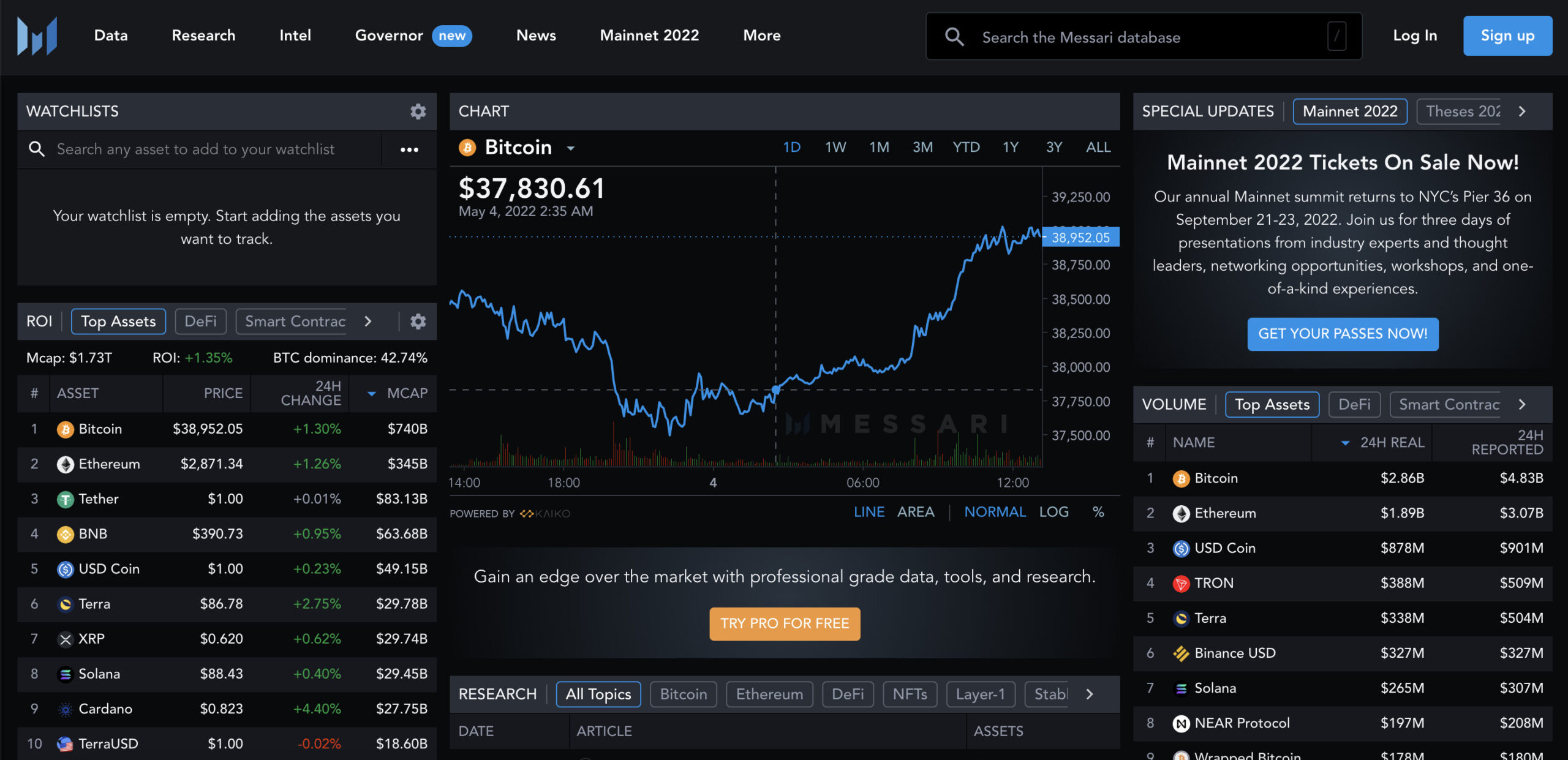

Messari (messari.io/) – Users can gain an edge over the crypto market with professional-grade data, tools, and research. DAOLaunch has used Messari to conduct token and crypto research to assist our future-facing decisions.

Marketing Data Analytics

- Social Media Account Followers

Social media growth is one of the most important indicators of a crypto project’s growth. In order to acquire new customers, the social media channels have to grow consistently. Crypto’s leading social media platforms include Twitter, Discord, Telegram, Reddit, Medium, and Facebook. It is helpful to be aware of the inflated numbers a lot of projects accumulate over a short period of time. Whilst it is generally understood that Web3 is currently onboarding many new users, a lot of projects have purchased fake followers to inflate their numbers to increase their levels of attraction. Using sites like Hype Auditor https://hypeauditor.com/en/ can assist you in identifying if a project has real or mostly fake followers.

Projects with inflated numbers due to botted followers are more likely to rugpull than not.

- Website Traffic Increase and PR

Whilst website traffic isn’t a leading factor in evaluating the growth of a crypto project, it is tied to SEO Search Engine Optimization which is very important to being found on the internet. A project with a good SEO strategy will have a higher authority score on Google, which impacts how often it appears on the internet and leading search engines.

A key sensible metric includes projects that have press releases and media coverage from notable publications and resourceful online platforms.

NB: This is not financial advice.

About DAOLaunch

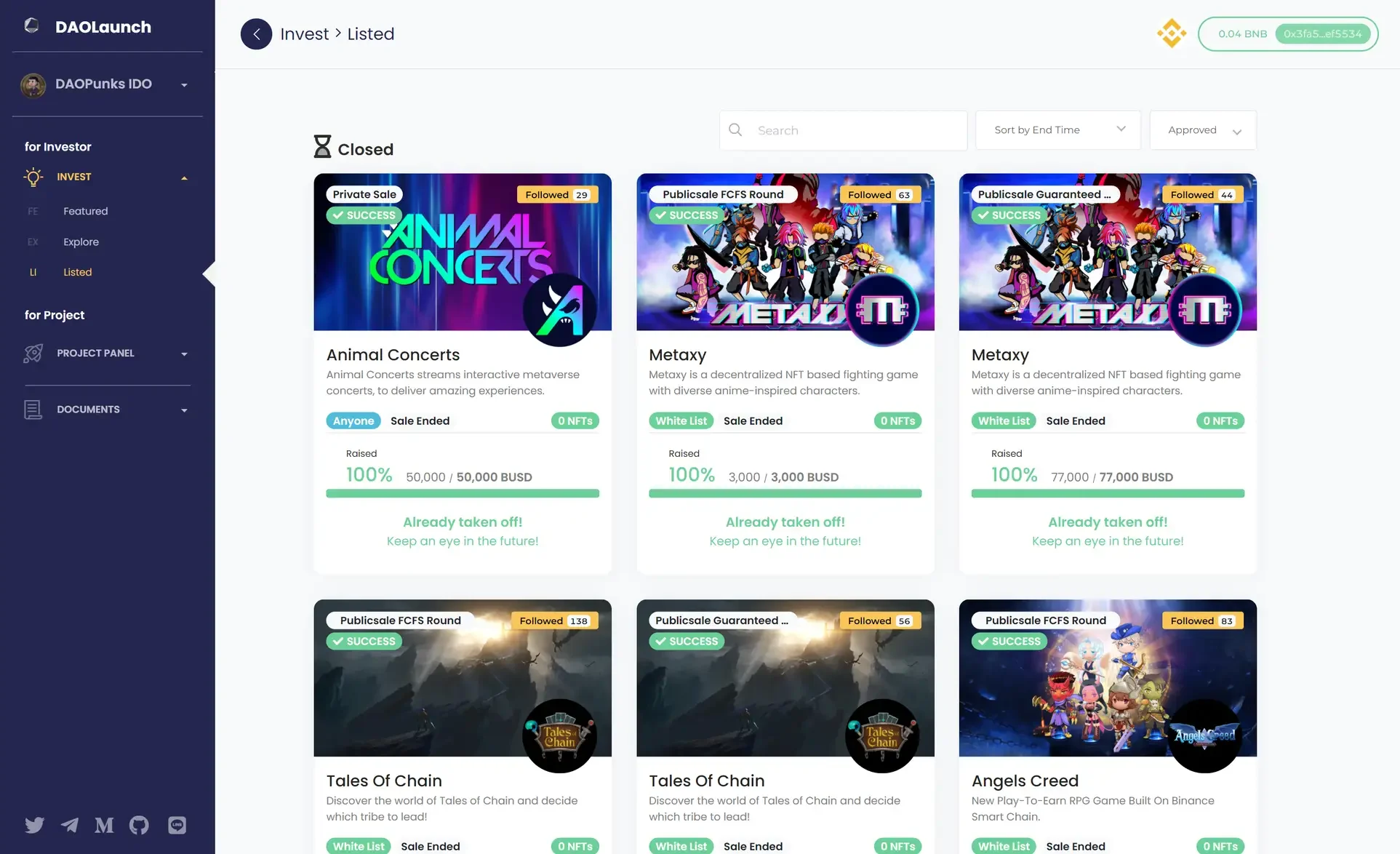

DAOLaunch aims to create an open and inclusive competitive environment for startup investment- the Decentralized Venture Capital concept.

DAOLaunch offers retail investors preferential investment conditions depending on their investment performance recorded on the blockchain. Recorded investments are not editable, as all negotiations are all on-chain. DAOLaunch investors can brand themselves as Decentralized Venture Capitalists and much like traditional VCs, they can negotiate more favorable investment terms.

DAOLaunch aims to change the structure of shady behind-closed-door investment deals to an open and more competitive deal structure that takes place on the blockchain. This will drastically shake up the startup industry.

Website | Telegram | Twitter | LINE OC | Discord