Deep dive into $121M raised Layer 1 startup, 5ireChain (Part2)

Deep dive into $121M raised Layer 1 startup, 5ireChain (Part2)

Token value is dependent on supply and demand.

The supply and demand function of a token is crucial in understanding the current value and potential future price potential. If the token demand is greater than the supply, the token price will increase, and if the token supply exceeds demand, the token will decrease in price.

Supply Side

For the sake of clarity, we will start from the supply side. On the supply side, the value of an individual token increases as the number of tokens decreases and the price of an individual token decreases as the number of tokens increases. (Law of supply and demand)

Of course, price/ valuation is dependent on much more than the amount of tokens in the market. Other things like utility, liquidity and market sentient are all really important factors, but for now, we will only consider supply and demand.

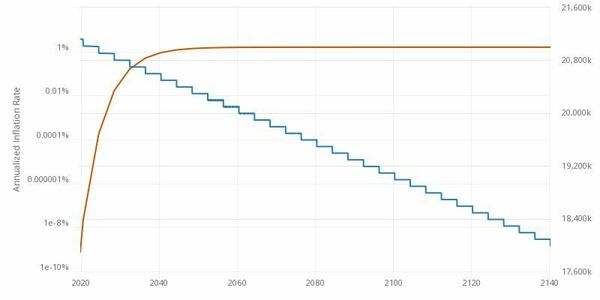

A simple example of supply and the corresponding value is bitcoin. It was created with a simple supply curve that takes about 140 years to exhaust.

Since there are only 21,000,000 Bitcoins and about 19,000,000 already exist, only 2,000,000 will be released (emission) in the next 120 years. In other words, since 90% of the supply is already in circulation and only 10.5% more Bitcoins will be available in 100 years, it is safe to assume that the inflationary pressures will not cause the coin’s value to drop.

On the other hand, there is Ethereum, with approximately 120,264,883 Ethereum coins currently in circulation, Ethereum has no limit to its supply. However, the Burn Mechanism regulates the stable supply, and there is even a possibility of deflation in the future. With this in mind, inflationary pressure is not expected for Ethereum ether, so it is unlikely that the coin’s value will decrease due to inflation.

Dogecoin also has no supply cap and is currently inflating at 5% per annum. In other words, out of the three, Dogecoin is the most likely to see a drop in the value of Doge coins due to the inflationary tokenomics design. Back to 5ireChain.

5ireChain is a fixed supply token.

The 5ire chain token has a hard cap of 1.5B. This is the same supply model as Bitcoin, Near, Cardano, Fantom, and Polygon. On the other hand, both Solana and Avalanche are inflationary tokens with no fixed cap, otherwise known as unlimited inflation.

Of course, since 5ireChain has not launched its main net yet, there is the possibility that the value could drop due to a lack of demand and token emissions.

5ireChain is expected to have a high ROI.

When considering getting a High ROI, it is important to know your entry and exit price. To be profitable, you need to buy when the tokens are cheap and sell when the value is high. *sounds simple enough

When considering the value of a token, you must consider the market cap, which is calculated as price x circulating amount.

In other words, to get a high ROI, you need to invest at a low market cap and sell at a high market cap.

The good thing about investing in a startup is that you can invest at a low market cap as there is a higher risk: reward ratio.

Comparison with other Layer 1 chains

5ireChain has an Initial Market Cap of $1.75M, which is by far the lowest compared to other Layer 1 chains. This figure is in line with public sale3, so only 5,833,333 tokens will be available at TGE, since the IMC is $1.75M at $0.3 per token. Compare this to other Layer1 tokens.

As you can see at a glance, 5ireChain has by far the lowest Initial Market Cap (IMC) compared to other Layer 1 products. Solana is 71x higher at IMC, Avalanche is 174x higher at IMC, and Fantom is 79x higher at IMC. In other words, they are overpriced at IMC when compared to 5ireChain. No other chain has such a low IMC at Layer 1. This prevents selling pressure. In addition, when the tokens are discharged afterward, the first-time-staking-only premium is added to increase the staking ratio of the tokens, further reducing selling pressure.

Demand Side

When looking at the Demand side in Layer 1, there are two important aspects: the amount staked in SPoS and how much VC money the project has raised as well as innovative startups participating in the ecosystem.

Staking in SPoS

Rewarding stakers is the key to building a resilient, reliable, and immutable network. Compared with other chains how many more (or less) validators are securing the network, how decentralized is it? Decentralization is an important factor when competing with other Layer 1 chains and the best protocols attract a wide variety of people from all walks of life. Therefore, the consistency and total value of rewards paid to validators are of utmost importance.

The 5ireChain team knows this, and you can read their intentions in the following statement from Tokenomics

“We are committed to providing the best staking returns to all our validators and nominators, but we are equally concerned about inflation and want to generate scarcity. The Model of Dis-Inflation is proposed to implement this task, and staking reward will decrease with time, but rewards in the form of the transaction fees will be increased in that proposition.”

Since this is still before the mainnet launches, we cannot describe specific numbers yet, but they will be revealed soon.

Attracting VC money/startups

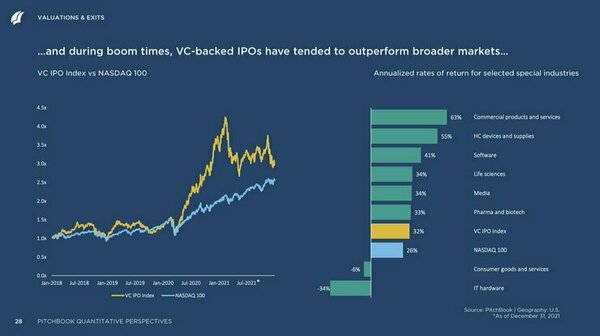

Why have Layer 1 chains received so much VC investment? The answer is the Fat Protocol thesis, which states that in blockchain, the protocol layer has a higher return than the application layer. web2 had a higher return for the application layer, such as GAFAM, while web3 had the opposite.

However, the increase in the value of the Layer 1 protocol in recent years does not mean that the Fat Protocol theory has been proven, but only that money has come in from VCs who believe in the Fat Protocol theory, and the value of the tokens has increased as a result.

However, by bringing in VC money, the ecosystem development fund and incentive programs can be conducted using treasuries using a large amount of capital marketing and significant investment. This allows them to attract startups and get the economic flywheel going.

This Data also proves that VC money has a lot to do with startup growth.

This is why it is important to raise funds from VCs.

The question is; will 5ireChain likely be able to raise from VC in the future? Personally, I think that the probability of 5ire raising another round is higher than other Layer 1 chains when one considers the Fat Protocol theory and the recent boom in impact investments.

To begin with, impact investment is an investment that aims to solve social issues through investment, in addition to the conventional economic return.

Looking at the world, impact investment will be $2.3T in 2020, while startup investment will be only $300B. The difference between impact investment and startup investment is said to be more than 7 times larger. To capitalize on this emerging trend and display its unique value proposition, 5ireChain has already entered into partnerships with the Indian, US, and Nigerian governments, so we can expect more investment.

Lastly, as for attracting startups, in addition to the above-mentioned VC grant, ecosystem fund, and social startups to solve social problems, 5ire chain has also created its own fund called 5ire Capital.

I hope this has helped you understand 5ireChain a little better. I hope you all remember to DYOR.

Disclaimer

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by DAOLaunch or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. DAOLaunch is not a fiduciary by virtue of any person’s use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold DAOLaunch, its affiliates, or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.