Deep dive into AVEM (Part3) – TradiFi to DeFi: AVEM solves this problem

Deep dive into AVEM (Part3) – TradiFi to DeFi: AVEM solves this problem

We explored the question 「Which L1 could survive?」in our last article and came to the conclusion that any layer1 chain, at the bare minimum, needs good, unique projects on the chain to attract users; this requires strengths that the Ethereum ecosystem does not have. Today, based on the conclusions we reached, I will explain AVEM; “a project to attract institutional investors to DeFi,” which has strengths that the Ethereum ecosystem does not have. In this video, we will first discuss the interest of institutional investors in DeFi, how many institutional investors are actually coming to DeFi? What are the bottlenecks and challenges, and finally we will discuss AVEM!

Institutional investors are coming.

The entire crypto industry, including Bitcoin and Ethereum, is currently in a bear market; Bitcoin is down 70% from record highs and Ethereum is down 75% as of 15/Jun/2022. The crypto asset industry experienced a crash as well in 2018, with Bitcoin falling more than 80% from its 2018 highs and Ethereum falling more than 90%. While there are countless ways things are different from then, the important thing for the crypto industry is that institutional investment is coming into DeFi.

Why are institutional investors coming?

Institutional investors are actually coming into the crypto industry, which until 2018 was mainly private investors, and their numbers and amounts are much higher than in 2018: in 2021, institutional investment via coinbase alone increased to $1.14 trillion, 10 times the amount in 2020. Interest from institutional investors is also increasing, with one report showing that over 80% of institutional investors are permitted to have exposure to crypto assets.

Infrastructure is building.

So why is there such an increase in interest and investment from institutional investors now compared to investment 2017-18? It is because the infrastructure for investing is being created at a level unmatched in 2018. The main categories are 1. exchanges, 2. Borrowing/Lending, 3. custody

- Exchanges: In 2017 most exchanges were for retail investors and many of the CEXs were just starting to develop their services for institutional investors as of 2017-18. Now Coinbase, FTX, Binance and other leading CEXs have grown to the point where they can handle the $1B-$100B transaction volumes required by institutional investors on a daily basis. Institutional clients are trading huge amounts on these platforms. In addition, these exchanges are expanding into developed as well as emerging markets. Africa-based VALR has over 500 institutional clients.

- Borrowing/Lending: The development of infrastructure services to solve DeFi’s lending service problem is also much more advanced than in 2017, and Goldfinch Finance has been able to reach a non-crypto native audience and over-collateralize, two of the challenges to provide zero-collateral loans to real-world approved individuals or businesses, thereby addressing both of the limitations of crypto lending protocols. Maple Finance also provides direct access to high-yield, low-collateral loans. Existing and already successful DeFi projects are also planning to reach out to institutional investors, with Aave launching Aave Arc, which will thoroughly enforce KYC and AML, and Fireblocks providing a platform that offers a back-end solution for seamless integration of custody and DeFi, which already has more than 30 institutional customers. Fireblocks offers a platform that provides a back-end solution to seamlessly integrate custody and DeFi, and already more than 30 institutional investors have requested to be “whitelisted” themselves.

- Custody: State Street and BNY Mellon, two of the world’s largest custodial banks (i.e. financial institutions that manage securities on behalf of investors) responsible for the custody of nearly $50T in assets, are adding custody for crypto assets starting in 2021. Currently, the crypto asset industry includes prime brokerage for large clients (i.e. services that allow them to trade with multiple financial institutions by using one financial institution. Comprehensive service for large institutional investors such as hedge funds. ) does not exist. Major crypto asset exchanges, trading firms, and custody companies are aiming to offer this service, and it appears that BNY Mellon is also aiming in that direction. This encourages institutional investors to enter the crypto asset industry.

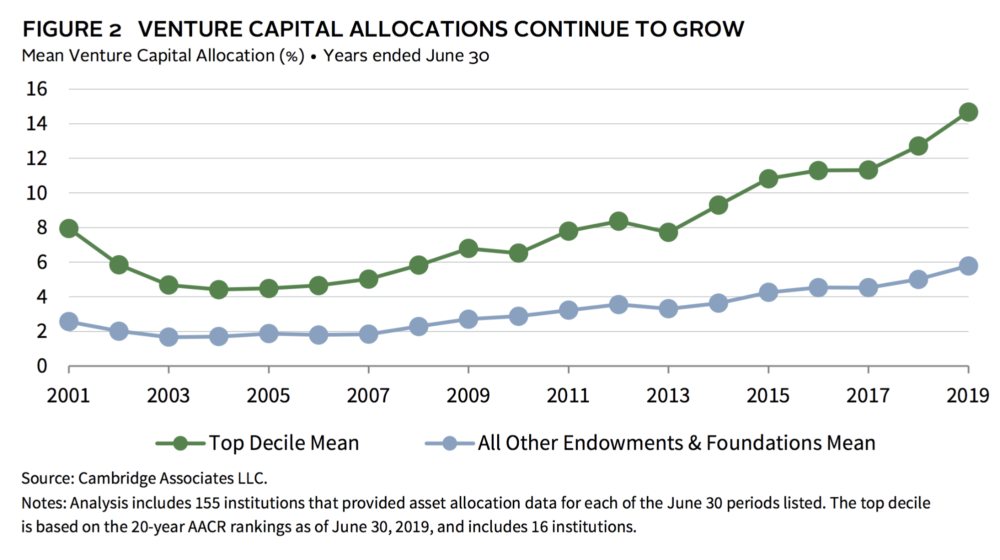

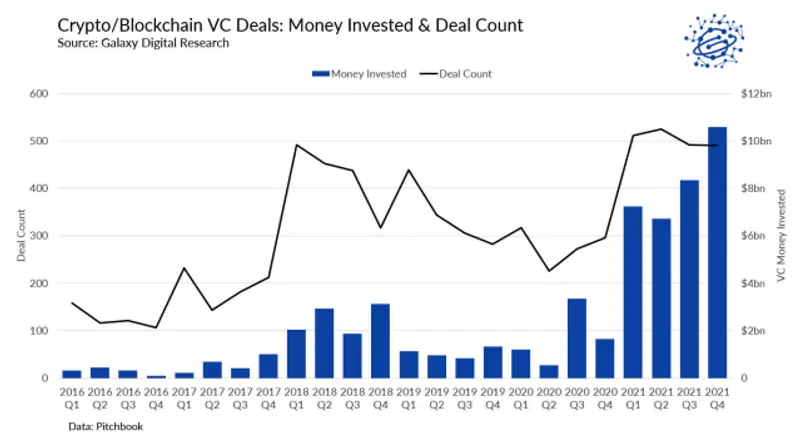

VC investment to web3 startups.

In the U.S., institutional investors typically allocate several percent to several dozen percent of their portfolios to VCs. This means that indirectly, the amount invested by VCs in the crypto asset industry is the amount invested by institutional investors. Allocations from institutional investors to VCs are increasing every year.

Source: Galaxy Digital Report

In 2017, there was less than $1B invested in crypto assets from VCs, but in Q1 2021 alone, there was 11x that amount.

Aside from what has actually been invested, Paradigm and a16z alone could drop nearly $5B from the funds raised in 2021. Despite this growth, even the $33B capital deployed in crypto companies is only 5% of the total venture capital deployed in 2021, so there is still upside.

Needed to drive the TradiFi to DeFi flow: develop ZKP, address CBDC, address regulatory relationships

So many institutional investors are interested in the crypto asset industry and are actually investing, and the amount is exploding every year. So what needs to be done to further encourage institutional investors to accelerate their investments in DeFi? I believe that ZKP (Zero Knowledge Privacy), CBDC (Central Bank Digital Currency), and regulatory compliance are key.

Development of ZKP

Companies are not convinced to adopt a public ledger without privacy considerations. Institutional investors are no exception. Zero Knowledge (ZK) technology is a breakthrough that allows companies to leverage public ledgers while preserving sensitive data and information details. Privacy is essential for enterprise users, but is difficult to achieve with the current public chain. The crypto asset industry benefits from transparent markets and liquidity pools, centralized exchanges, and other tools impose the same conditions on all players; ZK technology is making progress in bridging existing enterprise backends directly to established chains such as Ethereum. EY is making progress in this area and has announced Nightfall ver3 for 2022. It is open source and in the public domain and can be used by anyone. This development will hopefully turn it into a scalable, private transaction ecosystem that can run on Public Ethereum.

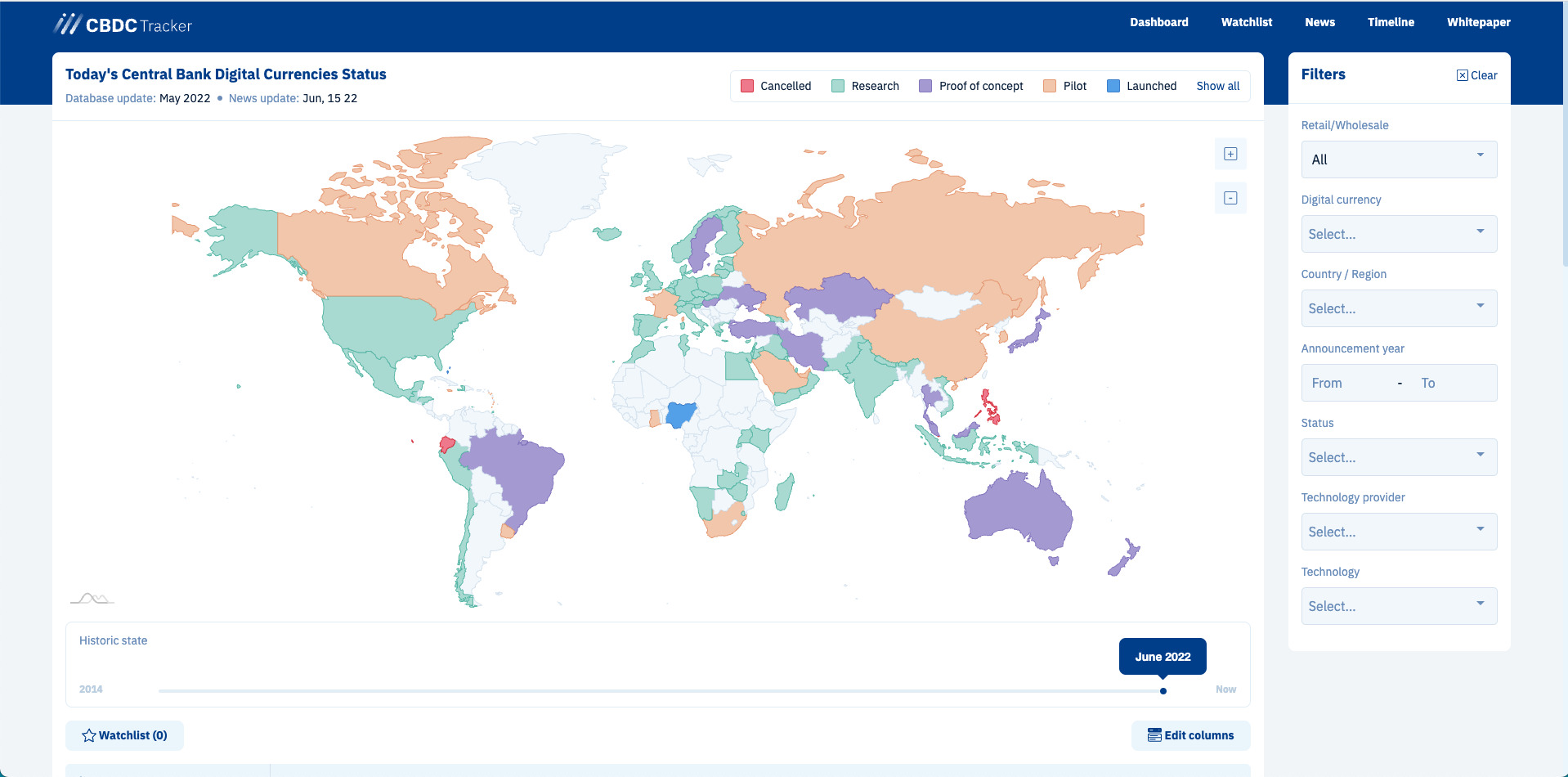

Addressing CBDC

Nations are likely to release CBDC this decade, and many are already in research, demonstration, and pilot status respectively in many countries, and are seconds away from being released.

(Source: CBDC Tracker)

Widespread adoption of CBDC means exponential growth of on-chain data assets: not only CBDC/crypto assets but also traditional stocks, bonds, etc. can be exchanged for CBDC or crypto assets. This means that DeFi will receive the liquidity of conventional financial assets on the on-chain, which will be important to attract institutional investors to CBDC.

Regulatory Affairs

State regulation is often used to police the crypto market. The timing and exact details of regulation are not yet known, but it is likely that the broader DeFi market will split into regulated permission and permissionless markets. As mentioned earlier, Aave Arc has launched and offers a pool of permission-based products that all users can use to meet existing KYC and AML compliance frameworks. As the field matures, it would not be surprising to see these permission-based protocols incorporated into key protocols in the various Layer 1 ecosystems.

This will not eliminate existing permissionless DeFi usage from the market. Users and businesses alike are likely to seek jurisdictional freedom when governments restrict access to financial tools that will become increasingly important in the coming years. Permissionless DeFi is contagious and spreads like a virus, and governments around the world have already proven unable to slow the spread of viral information and disease. You will be free to trade in either the permissioned or permissionless market.

There must be some compromise between a regulated market and a completely free market in order to attract institutional investors. Fortunately, the open and verifiable nature of cryptos is likely to provide individuals and companies with the tools to facilitate these negotiations; DeFi audits and risk assessments will be conducted in real time, and the ZKP will allow companies to prove compliance without having to disclose information that would make them less competitive in the marketplace.

Why can AVEM play a role in DeFi?

What is AVEM in the first place?

Avem is an institutional DeFi infrastructure built as a Layer 1 blockchain. The chain is being developed on top of Polkadot, and Avem is a parachain in the Polkadot ecosystem that can offer financial banking products to both retail and institutional users in an interoperable and scalable manner. Avem will be able to offer competitive financial banking products to both retail and institutional users in an interoperable, scalable and secure manner. The company’s headquarter is located in Sweden, a hub of many family offices and institutional investors, The project is currently in seed stage.

As mentioned earlier ZKP coverage, CBDC, and regulatory requirements for attracting institutional investors to DeFi Avem will all handle all the regulatory requirements at the protocol level in compliance with Swedish and Finma (Swiss Financial Market Supervisory Authority) laws.

The addition of compliance and ZKP are expected to bring institutional and Family Office clients to DeFi while complying with Swedish and Finma regulations in a permissioned market. Furthermore, KYC and AML compliance frameworks can be adapted to the chain itself, offering services that can only be deployed in a permissioned system.

Differences from big DeFi Players

However, even if AVEM is able to clear the hurdle of ZKP, CBDC, and regulatory-related issues, we have not accounted for the competition aspect. How will AVEM differentiate itself from Aave, Compound, and Fireblocks, the well-established DeFi players that are already successful and trying to secure institutional investors mentioned above? AVEM is a Layer 1 chain, unlike other DeFi projects, and differentiates itself from the Ethereum ecosystem and the apps built on top of the Ethereum ecosystem.

Unlike other DeFi projects, it is a Layer 1 chain. The DeFi projects I mentioned earlier are dapps, not a Layer 1 chain; AVEM is a Layer 1 chain, so it can offer Nominated Validators and Institutional Nodes to whitelistedl investors.

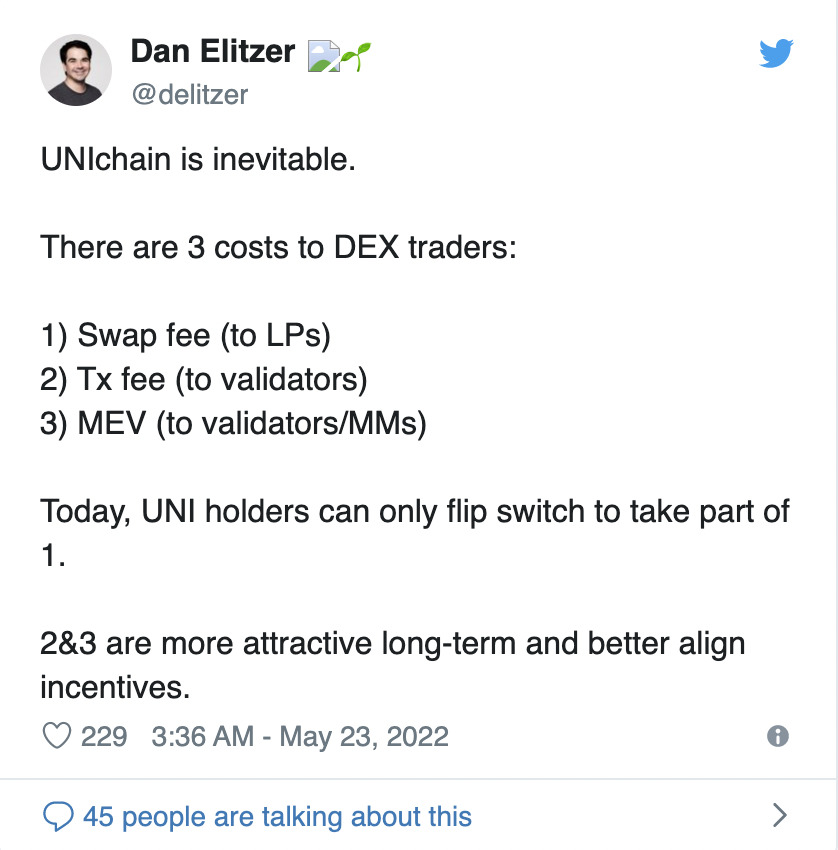

For example, Uniswap, the most famous DEX, can only give back Swap fees to LP providers, while Layer 1 chains can offer Tx fees and MEVs to users at the same time.

Differentiation from the Ethereum ecosystem. So far, I explained 「Why we should invest in Layer1 chain」and 「Which L1 will survive?」The conclusion was that “Layer 1 chains are the most profitable and lucrative, but that is only possible with promising projects that have a large number of users on the chain. Emerging chains will not flourish without promising projects that can attract users. AVEM is a permission-based marketplace. AVEM is attacking the market in a way that Ethereum does not (the approach of bringing institutional investors to DeFi). As explained above, the permission-based design and compensation design unique to the Layer 1 chain allows it to bring in more institutional investors.

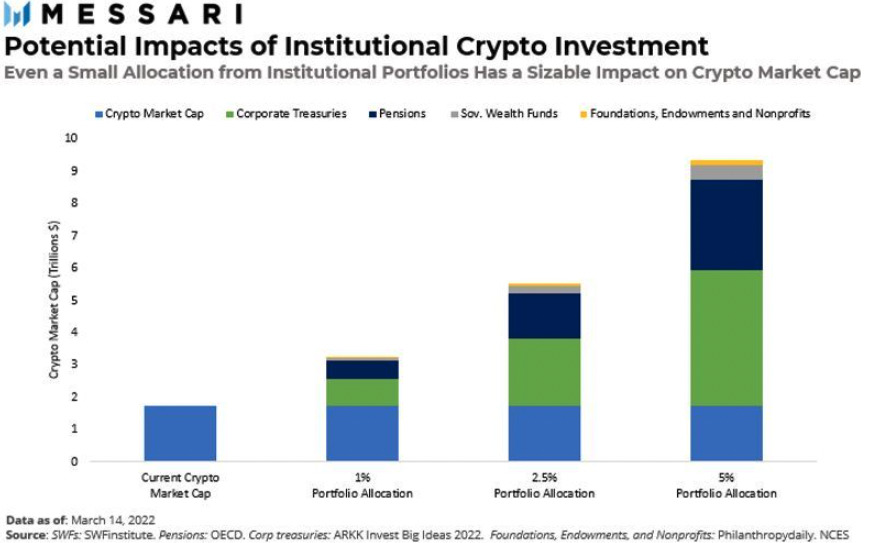

Source: Messari

Last but not least, it is only a matter of time before some of TradiFi’s investment is turned over to DeFi. The current crypto market is $1 Trillion (as of 16/June/2022), and if 1% of an institutional investor’s portfolio were to turn to crypto, that would be about $2.5, more than 2x. The key in today’s bear market is not to be swayed by the market, but to encourage investment in technology, growth, and innovation.

Conclusion

Repeat the main points again in 3 articles

- L1’s accrue the most value and are less risky than other dapps and crypto assets. They should be a main part of your investment thesis.

- Not all L1s will survive, they must attract good devs, startups and offer competitive grants, They must also differentiate themselves from Ethereum.

- Avem is a permissioned L1 chain that targets institutional investors that differentiate themselves from Ethereum ecosystem

- You learn more about AVEM from here and their official links